STRATEGY

An investment in Aquabanq is an investment in America’s critical infrastructure. We are building the national assets required to secure our domestic food supply. Our Investor Relations area contains additional information for Accredited Investors on partnering with the future market leader in domestic seafood production and accessing Aquabanq’s Data Room.

Our Phase 1 national rollout is designed to establish Aquabanq as the largest U.S. producer, putting us on a clear path to capturing over 33% of the premium shrimp segment within eight years.

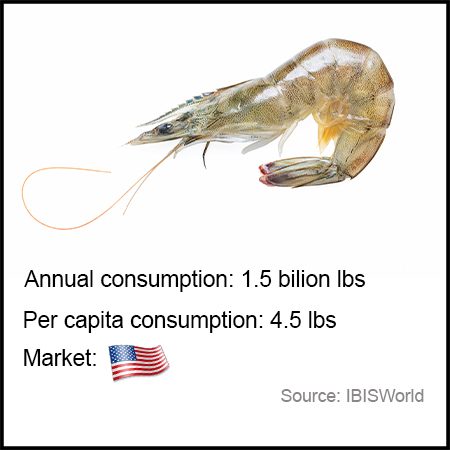

We decided to focus on shrimp, specifically the Whiteleg species that holds the largest market share, because Americans love shrimp, which is by far the most popular seafood in the United States. Shrimp dominate the market by consumption per capita and account for 25-30% of the entire seafood market in the country.

With shrimp reaching market size in the controlled environment of warm-water RAS in just under four months, we expect each production unit to start generating revenue within the first year of investment. Additionally, we believe that a deployment of true zero-discharge RAS, which requires only small amounts of water daily and does not need NPDES discharge permits to operate, heralds a paradigm shift in shrimp aquaculture. Instead of the traditional model, where massive farming facilities produce upwards of 10,000 metric tons of shrimp annually in a single location, this zero-discharge technology allows us to build smaller facilities close to market, each with an aggregate capacity of up to 5,000 metric tons. This model not only dramatically reduces transportation costs but also significantly reduces economic, biological, and regulatory risks. It will also eliminate the need to engage with large retailers, minimize logistical overhead, and enable us to match production with local demand. Breaking from the geographic concentration, we have created an expansive roadmap: over 179 production units stretching from West Virginia to Texas to Nevada, and many places in between.

In conclusion, we believe that diversifying our income streams both by geography and through distinct distribution channels will de-risk the investment and make Aquabanq less vulnerable to the factors beyond our control. It will stabilize our cash flow and enable us to achieve a high capital growth across the entire timeframe we expect to invest for.

Market Opportunity

The U.S. is the world’s second-largest seafood market, yet it remains critically dependent on imports. The total U.S. shrimp market is valued at nearly $6 billion wholesale, with Americans consuming over 1.7 billion pounds annually.

Food safety and sustainability drive sales. Shrimp that is locally-raised, fresh, and free from antibiotics, GMOs, and other pollutants command premium prices, and all recent surveys indicate that seafood consumers are placing sustainability and food safety before price and/or brand.

Our focus is the premium, large-shrimp segment (sizes 21/30 and above). This specific addressable market represents a $3 billion wholesale opportunity of over 500 million pounds per year, accounting for 50% of the total shrimp market.

Our Phase 1 national rollout will produce nearly 49 million pounds annually, securing approximately 10% of this premium segment by volume and establishing Aquabanq as the largest domestic producer on day one. Our subsequent Phase 2 expansion is designed to scale to 165 million pounds, capturing over 33% of the premium market by volume within eight years, solidifying our position as the undisputed market leader in domestic seafood production.

The on-trade channel dominates shrimp sales, with Americans allocating 65% of their seafood expenditure in restaurants, which prominently feature shrimp. From 2016 to 2021, shrimp product sales through the on-trade channel surged by 36.6%. The growing popularity can be attributed, at least in part, to the numerous health benefits of shrimp that have encouraged higher consumption in the United States in recent times.

The online channel is expected to be the fastest-growing distribution channel in the on-trade segment. It is projected to register a CAGR value of 12.62% during the forecast period (2022-2028). This growth is due to the increasing number of smartphone users, which increased by 11 million between 2020 and 2021. Around 45% of the population browse online websites through mobile devices. The sales of processed shrimp through online channels increased by 127% during 2016-2021.

Shrimp is the two most popular seafood species in the United States with the largest market shares:

Americans eat a total of 1.5 billion pounds of shrimp a year. That works out

to about 4.5 pounds per person.

to about 4.5 pounds per person.

U.S. is the second largest fish and seafood importer in the world with a small and fractured aquaculture industry, with no major domestic players, and a lot of room to grow: